English version

You find here an overview of the current projects of our partners and own projects

No. 09-20e Growth Financing "Fintech Startup" Web application for the automated matching of investors to initiators based on many parameters using adapted algorithms. We are looking for investors to complete the app development and additional capitalization, in particular to expand the strategy and implement further investor databases Planned annual payout of 7.5-9.00% + additional interest depending on the term and the annual result Capital protection via various models up to 100% possible.

No. 11-19-1 Event and tourism project, rental of hardware, EUR 900 thousand, EBITDA over 25%. Capital protection 100%

No. 11-20-9 Real Estate Project Austria, Mortgage lending, participation EUR 10 million, EBITDA over 20%

No. 03 / 1-16 Sale of companies (shares), successions, etc. from EUR 100,000 to EUR 135 million. Concretization in case of serious demand, taking account of discretion.

The price structure ranges from EBIT x 4 to 10, depending on growth prospects.

No. 06 / 19b Combined heat and power plant Germany, progn. ROI about 16-178; No. 06/17; CHP Germany 2 - 3.75 MW / h seeks investor / financier (4-10 million EUR)

No 09/20 Loan i. H. v. EUR 40,000 - EUR 3.000,000 for business start-ups from distributors, initiators offer 7% - 10% p. a. + Bonus

No. 20 / 08 Search Process support for prospective claims for damages (7-digit) against creditworthy defendants. Parts of the procedures are already being carried out by institutional investors who are only active from EUR 50,000 (or criminal proceedings in preparation), so additional partners are being sought for smaller procedures. The success of these institutions is 20% p. a. , We offer more! In addition to the following partial procedures, 35% - 350% p. a. For a) 5,000 EUR, b) 12,000 EUR c) 40,000 EUR. Safeguarding of success and access to the documents are self-evident.

No. 04 / 08-2 Investors are looking for direct sales portals in several sectors. Proven concepts ensure yield and possibly further synergy effects. Participation directly or indirectly. For further information please contact us. Collaterals etc. available. Also gladly active participation of sales and Internetprofis.

No. 13 / 09-3 Investors for contract financing (interim purchasing and sales financing) from EUR 50,000 (per branch) through leasing agency sought. Alternative factoring. Please only serious inquiries from potential prospective customers in Germany / A / CH / FL!

No. 20 / 09-3 Investors for share financing (minority / majority) from 50,000 EUR for carportal for leasing / financing / distribution incl. dealer network with an allotment feature at europ. market with very high growth prospects.

No 19 / 14-3 Loans and support for book publications (subjects and titles: economic crimes, corruption and political, etc.), burglar criminality and impact, fraud psychology and causes; a 10,000 - 25,000 EUR, revenue sharing (royalties) and partial rights recovery as collateral.

No. 10/19 Investor for wind turbines a 375,000 EUR, EBITDA ratio approx. 14%; Ready to build, under construction or on the web

No. 11/20 Biomass plants a 850,000 - 10,500,000 EUR, ROI over 17%

No 12/20 bioenergy combination a) 3 million b) 19 million ROI at least 25% p. al .; Land, patents and operators

(Follow-up projects with 300 million are being prepared), financing-participation-buying

No. 12/20 Investors for combined biogas plants i. V. m. Algae production, patented, experienced operator and initiator. Volume of 3.5 million to 18 million, patent owned by the initiator; A tried and tested, novel, patented, efficient manufacturing process. The investment promises a return (ROI) of approx. 30% with direct participation

No. 02/12 - 2 Investors for solar plants in Southern Europe. Volume up to 20 million, reference object available. Top locations! The initiator predicts a return on investment (ROI) of between 12 and 20% for direct participation and between 11 and 20 between 1 and 7 years on the net. Only serious bids with proof of capital and declaration of intent!

No. 04/20 Wind parks South Eastern Europe and Eastern Europe, South Africa, turn-key or rights sale of 10 MW - 600 MW

Other parks and equipment, new and used according to constructive, detailed request or specification.

Our partners are currently looking for wind turbine plants and project rights in Germany. 300 kW up to 3 MW preferred (on the net since 2005).

No. 07/20 Sale of hotels, D and EU, MR of 5 - 12%, with share-deals EBITDA ratio of 6-15%; Volume of 3 - 200 million EUR.

No. 11-19-1 Event and tourism project, rental of hardware, EUR 900 thousand, EBITDA over 25%. Capital protection 100% (parket)

This is only a small excerpt of our advertisers and projects, as much for reasons of discretion is only released when there is a concrete demand and matching of the details.

At the moment further requests are being checked. The total volume requested, including inquiries in the pipeline, currently amounts to more than EUR 6 billion.

We would like to point out that no "collateral" collateral exists, but individually equivalent hedges are possible. Often, these advertisers are livelihoods, which is why the sustainable concept and the investment to be backed up exist as counterpart. However, safeguards are fundamentally feasible. Assignments up to 100%

You can have your offer checked and, if necessary, set up according to a positive result free of charge.

The portal operators are not liable for the correctness of the information and intentions of advertisers! Even a comprehensive review can exclude criminal energy of market participants in the future 100%.

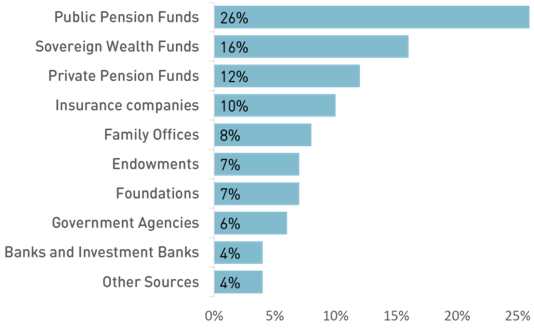

Overview of sources of capital procurement worldwide:

Individual Investors and Family Offices are a Rising Power in Private Equity